One port of call

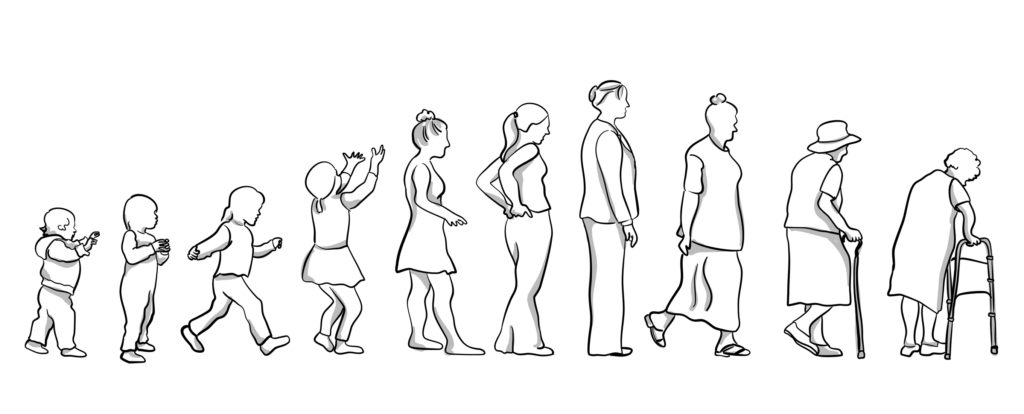

Financial planning is a journey, not just a policy. We can hold your hand through all your different life events and help you to plan so you can have funds available for them.

When you are growing up we can protect your parents in case anything happens to them. We can also look at ensuring they can fund your education or that you have a lump sum to help you on your way when you reach adulthood.

We can then help you with a mortgage to buy your first house and then subsequent ones, and help protect you against not being able to work due to illness, or dying prematurely. At the same time we can plan financially towards retirement and funding your later years.

As you come towards retirement, we can help you to see when you can afford to give up work, and how to rearrange your finances to suit your new lifestyle.

When it comes to those later years we can give you specialist advice towards funding the care you may need, to give you greater peace of mind that you can be cared for at home, or in a home, with the choice of where and how you wish to spend these last years. As part of this, we can help you to see if there is a risk of running out of money, and what you might be able to do to avoid this.

We can advise you on how to use your assets to look after yourself or those you love. We can help to identify whether you can afford to help out your family in your lifetime rather than them having to wait until you die; and minimise how much tax is paid by you in your lifetime, or by your estate after your death.

Monetary Solutions has a team of advisers qualified in these different areas giving you one port of call. We can utilise specialist software to diverse a plan and project ahead so that you have the confidence ensuring you have the funds when you need them.

Monetary Solutions Limited is a firm of Independent Financial Advisers based in Purley. We are qualified to give advice on most aspects of financial planning.