Savings and Investments

Advice on your savings and investments, from the experts at Monetary Solutions

Dealing with Savings and Investments may feel like a bit of a minefeld, however we can guide you to the best solution. In order to give the best, most appropriate appropriate advice, it is important that we get to know our client and establish their aims, objectives, and attitude to investment risk.

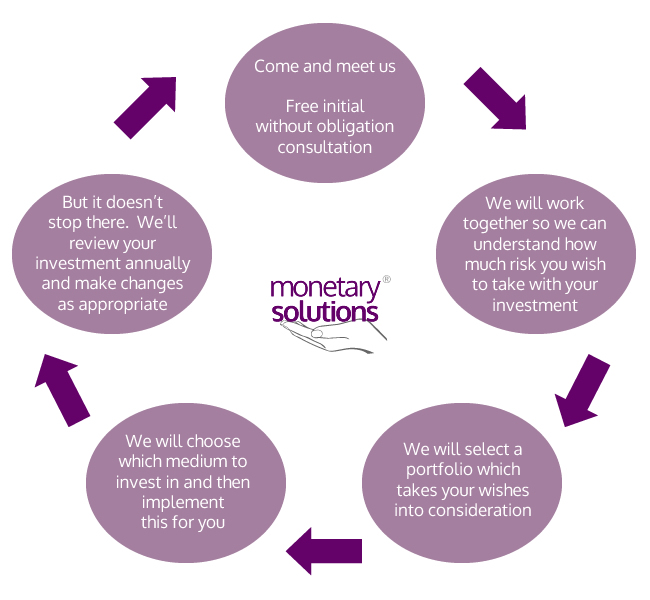

The way that we approach savings and investment advice at Monetary Solutions is best explained in this diagram:

Why Invest?

First and most importantly, cash often is not protected against inflation, and it’s spending power could reduce in time if action isn’t take. Secondly, if you are investing for the long term, taking more risks could actually bring you greater returns, although this is not guaranteed and your investment can go down.

In theory, this is all very well but equities, bonds and the income that they can earn you may go down in value as well as up. At Monetary Solutions we believe in diversification to help spread your risk.

What is Diversification?

Diversification is defined as the spreading of your portfolio across different asset classes, including equities, bonds, property, alternatives and cash. The main objective is to reduce the risk in your portfolio compared with that of investing in just one asset class.

Diversification is defined as the spreading of your portfolio across different asset classes, including equities, bonds, property, alternatives and cash. The main objective is to reduce the risk in your portfolio compared with that of investing in just one asset class.

In theory, the fact that your investment is spread across different types of assets means that when one asset is underperforming, the positive performance of another asset may help to compensate for it, though they may all go down at the same time.

The long-term nature of portfolio planning means that all asset classes are likely to have their ups and downs from time to time. Diversification means you don’t have to get wrapped up in worrying about which one you should be in – or out of – at any particular time. However, you should continue to monitor your investments regularly to make sure the funds you are investing are performing within their sector.

So if you are considering investing or wish to review your current holdings…